Almi Invest GreenTech

We invest in start-ups that contribute to a more sustainable future. Companies that reduce carbon emissions, protect natural resources or restore ecosystems. Our focus is on companies that create measurable benefits for both the climate and nature.

Investing in the future, one green investment at a time

Almi Invest GreenTech is one of the leading climate tech investors in the Nordics, ranked number 8 in Europe and number 26 globally by Climate 50, 2023.

What is the GreenTech Fund?

The GreenTech Fund is a strategic initiative from Almi Invest to support innovations that benefit both the climate and nature.

We invest in entrepreneurs developing solutions with measurable benefits for the climate or ecological sustainability. This may involve reducing emissions, protecting biodiversity or restoring ecosystems.

Since its launch in 2017, the fund has invested in around 40 companies and has grown to manage SEK 1.2 billion – across two funds. The latest, the Climate Fund, was launched in 2024 with support from the European Union and with approximately SEK 600 million in capital.

The mission of the GreenTech Fund is to contribute to the sustainable transition – by investing in innovations that reduce emissions, protect natural resources and strengthen ecosystem resilience.

Who can apply?

Companies eligible for investment from the GreenTech Fund must be Swedish, privately owned small and medium-sized enterprises (SMEs) that are not publicly listed. Their innovations must have a clear and measurable potential to reduce carbon emissions or improve the environment.

To qualify, the company must not have had commercial revenues for more than seven years. The focus is on companies with scalable solutions addressing major sustainability challenges.

How much capital do we invest?

Investment size: Almi Invest GreenTech typically makes an initial investment of SEK 5–15 million in financing rounds, which often range between SEK 10–50 million. We also have the ability to participate in follow-on rounds, with a total investment capacity of up to SEK 50 million per company.

Stages: We most often invest in the Seed to Series A stages.

A bridge to private venture capital

As a state-owned venture capital company, we are required to always invest together with independent co-investors. This means we can never invest alone. As a result, we share the risk, provide companies with access to more capital, valuable networks and additional expertise.

In this way, we act as a bridge to private venture capital, creating better conditions for new companies to grow and succeed.

How do we assess climate and environmental impact?

Clear criteria are needed to invest in the right companies. That’s why we have developed a method to evaluate both climate impact and environmental benefits in early-stage companies. We look at how much of a difference the company’s solution can make – for the climate, for nature and for the future.

Which sectors does the GreenTech Fund prioritise?

The GreenTech Fund invests in sectors with significant potential to deliver both climate and environmental benefits. This may include energy transition, circular solutions, water treatment, nature restoration or biodiversity protection.

These areas are crucial for addressing both the climate crisis and the growing pressure on the planet’s natural resources – and for building the sustainable business models of the future.

Energy transition

GreenTech sectorsSolutions that accelerate the shift to renewable energy, increase energy efficiency and reduce dependence on fossil fuels. Examples include innovations in solar and wind power, energy storage, smart grids and more.

Circular economy and material technology

GreenTech sectorsDevelopment of new materials and business models that support recycling and resource efficiency.

Transport and mobility

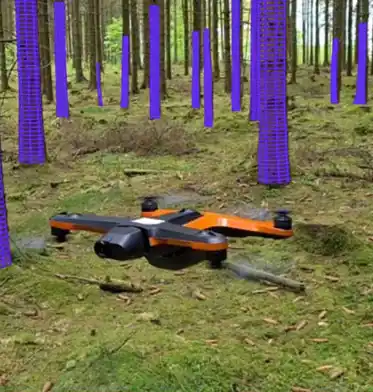

GreenTech sectorsInnovations that promote electrification, micromobility and sustainable transport solutions.

Industry, buildings and manufacturing

GreenTech sectorsEfficiencies and innovations that reduce emissions and energy use in industrial production and the building sector.

Innovative technology for agriculture, food and the biosphere

GreenTech sectorsTechnologies and innovations that improve food production, increase agricultural efficiency and strengthen the health of the biosphere to address sustainability challenges.

What do companies gain when we invest?

Companies we invest in gain not only access to capital but also strategic support and long-term opportunities for growth and development.

With us, you don’t just get capital – you gain an active, long-term partner. Our Investment Managers join your company journey and contribute strategic guidance through board representation. We are committed to your company’s growth and are there to support you through both successes and challenges.

When we invest in your company, you gain access to our extensive network of qualified co-investors across Sweden. Our network gives you the opportunity to build relationships with more investors, opening the door to long-term growth through follow-on investments and securing future financing.

The GreenTech Fund has so far invested in nearly 40 innovative start-ups across various sectors, all with strong ties to sustainability and climate improvement. These companies represent areas such as energy transition, transport and mobility, circular economy, sustainable food systems and industrial transformation.

The Almi Invest GreenTech team

Meet us

Boris Gyllhamn

Erik Madeyski Bengtson

Jonas Bergqvist

Jonathan Lannö

Jörgen Bodin

Linda Murray Wennberg

Manfred von Richthofen

Pinar Dagistan

Where to find us

| Gothenburg | Lund | Stockholm |

|

Masthamnsgatan 1

411 27 Göteborg |

Medicon Village Scheeletorget 1

223 63 Lund |

Västra Järnvägsgatan 3

111 64 Stockholm |

Almi Invest is co-financed by the European Union.